Upstart brings a different lens to consumer lending: instead of judging you only by a three-digit score, it evaluates broader signals to estimate risk and approval odds. That’s why many shoppers explore upstart loans when a traditional bank says no—or when they simply want a faster, digital experience. In this in-depth 2025 review, you’ll learn what upstart is, how its model looks beyond FICO, what the experience feels like end-to-end, who it’s best for, and how to decide if an upstart loan fits your needs.

- What Is Upstart? How It Works

- How upstart looks beyond FICO

- Eligibility, prequalification, and soft checks

- Application flow and account experience

- Products offered through the platform

- Rates, fees, and timelines—what to expect

- Pros of choosing upstart

- Potential trade-offs to consider

- Who upstart may be best for

- How to get started—smart next steps

- Verdict

- FAQs

What Is Upstart? How It Works

upstart is a lending platform that connects borrowers with bank and credit-union partners through an all-online application. The platform uses AI-driven underwriting to evaluate more than just your credit score, aiming to approve more qualified applicants and price credit more precisely. Products available through upstart and its partners include unsecured personal loans, auto refinancing, and—in some cases—HELOCs, depending on your state and the specific lender partner.

For everyday borrowers, the appeal is speed and simplicity: you can check your rate with a soft inquiry, complete the application in minutes, and handle the entire process online. upstart positions itself as a technology layer that banks use to make faster, data-informed credit decisions. Independent coverage and industry analysis frequently highlight the “AI underwriting beyond FICO” angle as the key differentiator.

How upstart looks beyond FICO

Traditional underwriting leans heavily on credit history. upstart augments that with additional variables (for example, employment and other application data), processed by machine-learning models to estimate your likelihood of repayment. The point isn’t to ignore credit scores; it’s to build a more holistic picture and potentially approve more people at appropriate pricing. Analysts and financial media often describe upstart as pushing deeper AI decisioning that sits on top of partner banks’ lending funnels.

This approach can open doors for thin-file borrowers or those rebuilding credit—groups that may not fit neatly into traditional score cutoffs. If you’re comparison-shopping upstart loans, this “beyond FICO” framework is the core reason to include upstart in your research.

Eligibility, prequalification, and soft checks

Before you apply, you can prequalify online. upstart and many lenders use a soft credit check to show estimated offers; accepting an offer and moving forward triggers a hard inquiry. That means you can explore options without dinging your score just to see rates. upstart’s educational pages and help center lay out the difference between soft vs. hard pulls clearly.

If you received a mailer or code, you can go straight to upstart.com/myoffer to check for a targeted offer with the same soft-check experience.

Application flow and account experience

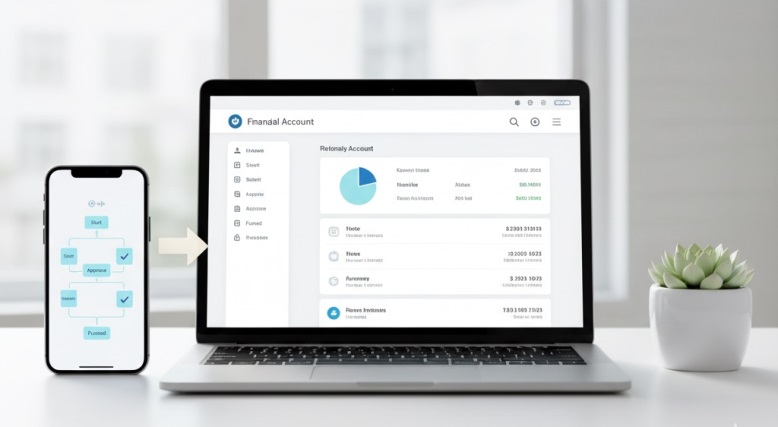

The application is streamlined: create an account, verify identity, share income/employment details, and review disclosures. Returning users can access their dashboard via upstart login, manage documents, and track status—again, fully online. New applicants often begin from the product page or the account creation page; both emphasize quick rate checks and no prepayment penalties on partner-issued loans. If you’ve already started, use upstart login to pick up where you left off.

Also Read: Traceloans.com Credit Score Review 2025

Products offered through the platform

Borrowers commonly consider upstart loans for debt consolidation, credit-card refinancing, big-ticket purchases, or one-time expenses. Depending on the lender, you may also see auto refinance and home-equity options in select states. Independent reviewers summarize upstart as a versatile digital gateway to these categories, with the platform acting as the decisioning layer for partner institutions.

Because every lender partner sets its own terms and eligibility rules, exact features, limits, and available products can vary by state and partner. That variability is normal for a multi-lender marketplace like upstart.

Rates, fees, and timelines—what to expect

APR ranges and fees are set by the issuing bank or credit union and depend on your profile, state rules, and the specific product. On unsecured personal loans, an origination fee may apply; there’s typically no prepayment penalty, and approved borrowers can sometimes receive funds quickly after final approval. The key takeaway: prequalify first, compare offers side-by-side, and read the cost disclosures before you accept. upstart’s official product pages and help center emphasize the soft-check preview and explain when the hard inquiry occurs.

If speed matters, upstart highlights an accelerated timeline for many borrowers—again, subject to partner processes and verification steps. upstart can be a fit if you value a streamlined digital journey and want to see potential offers without an immediate score impact.

Pros of choosing upstart

upstart offers a clean user experience, fast prequalification, and a more inclusive underwriting approach that may benefit thin-file or recovering credit profiles. The breadth of categories—personal, auto refinance, and sometimes home equity via partners—gives you multiple ways to consolidate or restructure debt within one ecosystem. Coverage from consumer-finance publishers consistently frames upstart loans as a strong option for borrowers who want a modern, fully online process with broader evaluation criteria.

Potential trade-offs to consider

Because pricing depends on partner rules and your individual profile, some applicants may see higher offers than with alternatives; terms are not one-size-fits-all. As with any financing, compare offers from multiple providers and consider total borrowing cost over time. Independent editors and user communities sometimes highlight mixed experiences—typical in lending—so weigh those perspectives against your own needs and timeline. upstart itself remains a legitimate, widely covered platform with years of operating history.

Who upstart may be best for

If you have limited credit history, are rebuilding, or want a quick online path to consolidate balances, an upstart loan could be a fit—especially if prequalification reveals competitive options from partner banks. If you’re ultra-rate-sensitive and already prequalify for top-tier pricing elsewhere, upstart is still worth a comparison, but you should weigh total cost carefully. Borrowers who prefer a branch experience may not value the fully digital nature of upstart as much as those who want speed and convenience.

How to get started—smart next steps

- Prequalify to see potential upstart loans without a score impact.

- Compare offers, fees, and timelines.

- Gather documents early to avoid delays.

- If you continue, complete your application and monitor your dashboard via upstart.

- If approved, repay on time and consider early payoff if it reduces total interest.

These steps align with upstart’s own guidance on soft vs. hard checks and with independent reviewers’ advice to compare total cost before accepting.

Verdict

For borrowers who want a modern, mobile-first experience and a model that evaluates more than just a FICO score, upstart stands out. Its AI-assisted underwriting, broad partner network, and simple digital flow make upstart loans a compelling option to include in your 2025 short-list. Prequalify, compare, and decide—upstart gives you the tools to do that quickly and transparently.

FAQs

1) Is Upstart a direct lender or a marketplace?

Upstart operates a platform that connects borrowers to bank and credit-union partners; those partners originate the loans.

2) Does checking my rate affect my credit score?

Prequalification uses a soft inquiry; accepting an offer and submitting a full application triggers a hard inquiry.

3) Can I manage everything online, including payments and documents?

Yes—applications and account management are handled online via the borrower portal.

4) What types of loans might I see through the platform?

Depending on your state and partner availability: unsecured personal loans, auto refinance, and sometimes home-equity options.

5) Are there prepayment penalties?

Upstart highlights no prepayment penalty for partner-issued personal loans; always review your specific disclosures before accepting.